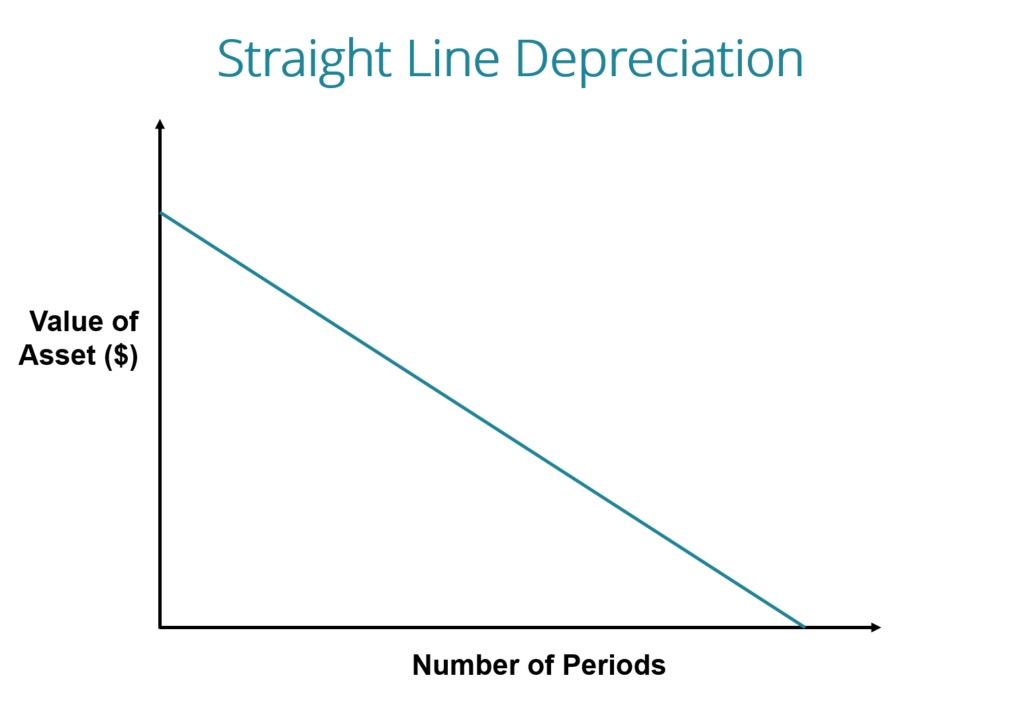

Straight Line Depreciation formula is one of the depreciation methods, where the value of fixed assets decreases with time and use.

The default method to calculate the fixed asset’s decreased value with time and use is called Straight Line Depreciation. Over each full accounting year, this method allocates the same amount of the percentage of fixed assets.

This method is for showing the consumption pattern of the underlining fixed asset. However, this method uses whenever there’s no particular pattern to how assets are useful. So it is the easiest method to calculate the depreciation and results in the lowest calculation errors. This method is recommended to calculate fixed asset depreciation.

Table of Contents

How to calculate Straight Line Depreciation

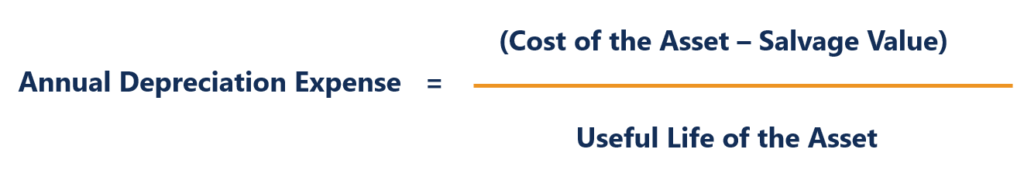

Straight Line Depreciation formula for an asset:

- Where useful life of asset shows the number of years, that shows the asset used by the company.

- The cost of an asset is known as the purchase price of assets.

- Salvage value is known as the value of the asset.

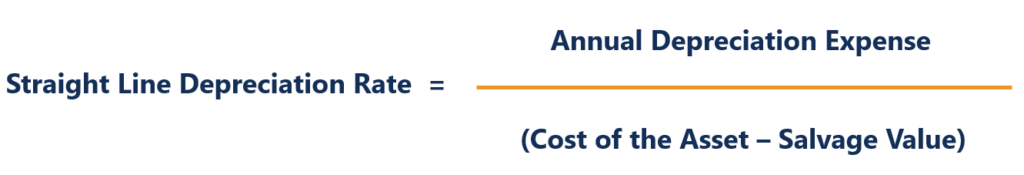

The rate of Straight Line Depreciation:

How can we calculate Straight Line Depreciation?

Whenever you use the Straight Line Depreciation method, it shows depreciation expenses evenly and estimates fixed assets’ full life. The calculation for Straight Line Depreciation given below:-

- First, estimate the initial cost of the asset that has been shown as fixed assets.

- Secondly, subtract the estimated salvage value called the estimated asset value at the end of its useful life. It is the easiest way to use the standard of living for each class of fixed assets.

- Then determine the actual estimated useful life of the asset. Simple use of life for each class of assets is the easiest way.

- Then to arrive at the rate of Straight Line Depreciation, divide the actual value of useful life by one year.

- Then multiply the depreciation rate by actual fixed asset cost (less salvage value).

Calculation of straight Line Depreciation is useful for accountants

The Straight Line Depreciation method is one of the easiest ways to calculate the depreciation of fixed assets. So that is why the accountant commonly uses this method. The Straight Line Depreciation method is not appropriate, and it does not show any correct difference in the usage of assets.

For example, rapid technology advancement, a Straight Line Depreciation method is not suitable for assets such as a computer, laptop, and other small machinery. A computer, laptop, and other small machinery would face depreciation expenses in its early life. Due to rapid technological advancement, it has to face little depreciation expenses in the later periods of its useful life, the reason behind it is (quick obsolescence of older technology). It is inaccurate to assume that (computer, laptop, and other small machinery) would incur the same amount of depreciation expense over its entire useful life.

There are some other methods to calculate the depreciation

There are other additional methods to calculate depreciation instead of Straight Line Depreciation. Other different asset depreciation methods are used to find a more accurate reduction and the current value of assets. A company can elect one depreciation formula to gain tax or cash flow.

1. Double-declining method:

This method is a type of increased depreciation that reduce faster than the Straight Line Depreciation method. The double-declining balance method results in a higher reduction at the beginning of asset life and reflects lower depreciation expenses later. This method with assets that quickly lose value early in the beginning of their life. A company chooses a double-declining method to calculate depreciation when it offers them tax or cash flow advantage.

2. Unit Production method:

The production method units depend on an asset’s usage, activity, or units of goods produced and time. Therefore, depreciation would be higher in high usage and a lower reduction in periods of low usage. This method can be used to depreciate assets where importance depends on factor variation in usages, such as bikes and cars based on miles driven or photocopier machines on copies made.

Here are examples of Straight Line Depreciation

An ice cream vendor purchases an ice cream machine for $60,000. The ice cream vendor calculates the annual Straight Line Depreciation for the machine as:

1. Purchase cost $60,000 – estimated salvage value $10,000 = depreciation asset cost $50,000.

2. 1/5 year useful life is = 20% depreciation rate per year.

3. 20% depreciation rate × $50,000 depreciation asset cost = $10,000 annual depreciation.

Pros and cons of Straight Line Depreciation formula

Pros:

- Using the Straight Line Depreciation formula becomes better when Congress passes the laws that allow for more increased depreciation methods on tax returns.

- However, under the Generally accepted accounting principles rules, this method is faster than what management decides to employ on the reported financial statements. It gives an advantage to the management because it gives rise to the intrinsic value.

- Moreover, due to the nature of the Straight Line Depreciation method, the earning figures are accurate.

Cons:

- It creates a problem that the tax records do not match with accounting records.

- Sometimes adjustments need in the reported financial found in 10- K filing and annual reports.

- The difference between the cash flow system and income statement is a deferred tax asset will be put on the balance sheet is the simplified version of these adjustments. Under GAAP and the income to the IRS, the deferred tax reduced overtime at the end of the Straight Line Depreciation method.

Bottom line

Some generally accepted depreciation estimates provide some constraints. In publications such as Asset life tables, we found this generally accepted depreciation.

For example, one of the largest cleaning supply manufacturer, the Clorox company, uses the Straight Line Depreciation schedule in their calculations:

- Over 10-30 years, land improvements are depreciated.

- Over 3-15 years, equipment depreciates.

- Around three years of computer equipment depreciates.

- Leasehold and building improvements depreciate over 40 years.

- Between 3 to 7 years, capitalized software costs depreciate.

It gets clearer in a given period that how many leeway management has managing earning reports with the Straight Line Depreciation formula. However, it also seems that in determining Low or High earning reports, the management has a lot of discretion. This method is helpful for asset-intensive businesses.

order generic lipitor 20mg generic lipitor buy lipitor 80mg without prescription

buy ciprofloxacin 1000mg – cephalexin 125mg cost amoxiclav drug

buy ciprofloxacin 1000mg online – buy cephalexin online order augmentin 375mg generic

С огромной радостью разделяем новостью о релизе обновленной версии мобильного приложения от БК Олимп для Android! Это обновление преобразит ваш подход к ставкам на спорт, делая процесс простым и эффективным. https://olimpbet-apk.ru и вы получите доступ без труда к широкому ассортименту спортивных мероприятий, доступных для ставок прямо с вашего мобильного. Усовершенствованные функции управления профилем, интуитивный дизайн для легкости использования и значительное повышение скорости приложения обещают непревзойденный опыт. Становитесь частью сообществу энтузиастичных клиентов и делайте ставки с удовольствием в любом месте, в любое время. Установите последнюю версию приложения БК Олимп немедленно и погрузитесь в мир ставок с комфортом и стилем!

purchase metronidazole for sale – order generic oxytetracycline 250mg azithromycin pill

ciprofloxacin 500mg cost – buy chloramphenicol tablets buy generic erythromycin

valacyclovir 1000mg price – zovirax without prescription zovirax 800mg canada

ivermectin 6 mg oral – order tetracycline 500mg for sale sumycin 500mg generic

metronidazole us – order metronidazole sale buy azithromycin 250mg pill

lasix online buy – buy generic warfarin captopril 25mg oral

glycomet where to buy – order epivir without prescription lincocin where to buy

buy generic zidovudine 300mg – allopurinol 100mg pill

purchase clozaril pills – clozaril 50mg for sale pepcid oral

anafranil 50mg brand – order imipramine 75mg without prescription doxepin 25mg cost

buy generic hydroxyzine – pamelor online buy endep 25mg price

amoxicillin pill – buy amoxil without prescription ciprofloxacin 500mg for sale

brand cleocin 300mg – cost doxycycline order chloromycetin pills

azithromycin us – ciprofloxacin 500mg oral order ciplox generic

buy ivermectin pills – buy levofloxacin 250mg without prescription cefaclor 250mg generic

albuterol for sale – seroflo inhaler purchase theophylline without prescription

glucophage where to buy – januvia 100mg uk buy precose

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

lamisil 250mg for sale – buy griseofulvin 250mg sale buy grifulvin v pills for sale

order semaglutide generic – buy generic desmopressin order desmopressin online cheap