If you are planning to take up health insurance or any other insurance, you might first Google the same, and Policy Bazar will quote your insurance plans as easy as clicking a button. Technology has Transform the insurance industry and it’s easily accessible via a mobile app. With the rise of the digital economy, InsurTech companies aren’t the only ones relying heavily on AI tools and Big Data.

Table of Contents

A change in the consumer’s mindset

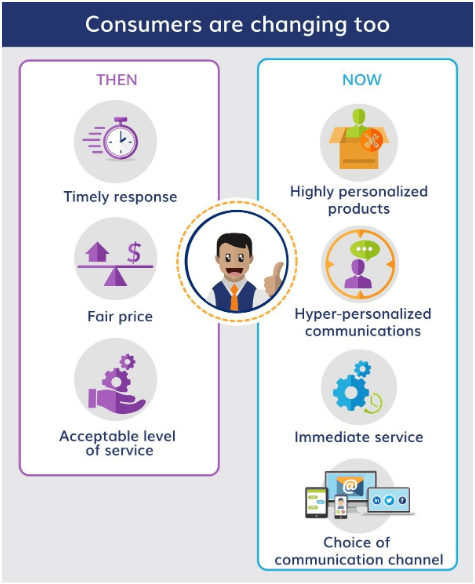

Consumer behavior, meanwhile, is shifting when it comes to insurance policies. In the past, a delayed reply was approved by insurance clients. With a good price and an appropriate quality of service, they were satisfied.

But the striker’s here:

Technology has transform the insurance industry and has opened customers to a degree of customer service that they now demand around the board of most sectors. They want personalized products and services. They want data that is important, easy to interpret, and contextual. And they want utilities at any moment, through the platform they want, to be available.

Consumers are now changing too.

Insurance clients deserve a consumer service equal to what they get from the top brands in every market, such as:

- Personalized interactions through cross-channels

- Seamless, cohesive, and connected journeys

- Personal data accuracy, security, and privacy

- Where, when, and how they want to communicate,

- Exchanges of importance above and beyond

- Interactions and reactions in real-time

Predictive Analysis

Predictive analytics is used by many insurers to gather a range of data to understand and forecast consumer behavior. Nevertheless, there are new ways in which it can be used to boost data quality.

Insurance companies can use predictive analysis for:

- Pricing and risk selection

- Identifying customers at risk of cancellation

- Identifying the risk of fraud

- Triaging claims

- Identifying outlier claims

- Anticipating trends

Artificial Intelligence

Consumers, especially when buying something as important as insurance, are often are searching for customized experiences. AI gives insurers the opportunity to create these exclusive interactions, satisfying new customers’ high-speed demands.

Insurers will increase claims turnaround times with AI and radically improve the method of underwriting. AI also helps insurers to view data more easily and in shorter amounts of time, leaving out the human factor will lead to more detailed reporting. In the way, carriers turn the handling of claims processes, AI and predictive analytics have become increasingly common and has transform the insurance industry.

A PwC study estimated that the initial effect of AI would mainly be related to enhancing efficiencies and automating current customer-facing processes of subscription and claims. Its effect would be stronger over time; it will recognize, analyze, and underwrite emerging threats and identify potential sources of revenue.

Machine Learning

Insurance industry technology trends include the overlapping of various technologies. Forbes suggests that “Machine learning is technically a branch of AI, but it’s more specific … Machine learning is based on the idea that we can build machines to process data and learn on their own, without our constant supervision.”

Machine learning does not only increase the processing of claims, but it can simplify it. They can be evaluated using pre-programmed algorithms as files are digital and available through the cloud, increasing processing speed and accuracy. This automatic review will have a larger effect than simple claims-it can be used for decision management and risk evaluation.

Telematics

The auto policy will continue to be influenced by the development of telematics and transform the insurance industry. In insurance technologies, think about telematics as the car’s wearable technology. Cars fitted with tracking systems calculate different metrics such as data on distance, venue, incidents, and more, all of which are tracked and analyzed with analytics tools to assess the policy premium, think Progressive’s Glimpse.

For both insurers and covered people, the advantages of telematics are multiple. In insurance, telematics will:

- Encourage healthier habits for driving

- The higher cost of claims for insurers

- Shift carriers from reactive to constructive consumer relationships

Chatbots

If you calculate from now, 90% of the customer interactions will be powered by chatbots by 2025. Chatbots will communicate with consumers easily using AI and machine learning, saving everyone time inside an enterprise and potentially saving money for insurance providers. A bot will walk a client through a phase of policy application or statements, reserving human interaction for more complex instances.

Geico’s “Kate” is a virtual assistant who connects via text or voice with clients, assisting with policy concerns and coverage requests, available 24/7. More insurance firms are investing in technologies like this, and it is expected that chatbot skills will expand in the coming years.

Cognitive Automation

Cognitive automation uses AI tools such as Natural Language Processing (NLP), pattern recognition, and image processing to simplify complex operations through roles such as insurance sales, customer care, risk control, underwriting, claims management, and regulatory reporting by replicating the human thought process.

Natural Language Processing (NLP)

NLP may have a far-reaching effect on customer experience by studying the grammar of the human language, both spoken and written. In the long run, reducing the need for call center workers will offer considerable cost savings. NLP will assist underwriters in drafting policies that suit the unique interests of a client, based on the review of a customer’s social media profile.

Computer Vision (Image and Video Analysis)

Computer vision scans images or videos to recognize patterns based on Deep Learning. Its application for protection includes a range of activities, including the detection of deception by checking the validity of records, the authentication of damage to the property prior to the processing of claimants, and even the signing of a contract based on a policyholder’s record.

IoT in InsurTech

AI aims to monitor user trends and risks by leveraging data from IoT products, based on which personalized deals can be tailored for people, whether it is underwriting an insurance program to meet the needs of the consumer or avoiding accidents or theft.

Key Takeaways for Insurance Industry by AI and ML

- Enhancing the pace of the procedure for allegations

You know how much time it will take from start to finish if you have ever made an insurance claim. Many clients fear that they will have to call an attorney and walk through the hundreds of questions required to conclude the claim, but AI wants to improve this procedure by speeding it up and making it more detailed. Instant reactions from chat boxes allow customers to get data instantly after an accident.

- Fraud Avoidance and Hacking Blocking

About $40 billion is robbed per year from insurance providers by theft, according to the FBI. Such dollars have lost leverage on both market productivity and customer prices. Companies using artificial intelligence may detect and monitor suspicious activities before it ever happens to deter hacking and other fraud.

- Adding to Solutions Personalization

As no two injuries or events are ever the same, AI also helps insurance providers to personalize their strategies. Taking a tailored approach helps organizations to customize their person-to-person offerings, which can help save money and maximize the customer experience. For example, an insurance provider might get approval to check someone’s driving with a basic AI application over the phone and thus use that information to change their premium. If they are a safer driver, their chance of injuries is smaller, so they may be offered a higher deal by the insurance provider.

- Give 24/7 Consumer Connectivity

24/7 connectivity without the need for a 24/7 workforce is one of the best benefits artificial intelligence provides. Organizations will save on staffing by still giving their clients around-the-clock value. Given the liability element of the insurance market, this is highly important as incidents can occur at any moment, and people need easy access to facts. Customers can use a chatbox to assist them through the process, rather than having to pick up the phone to get an agent on the line.

Conclusion

Through using artificial intelligence, insurance firms will increase their profitability and this will transform the insurance industry. AI not only helps make insurers safer from hacking and theft but also provides claims management with more detailed and accurate results. All of these qualities help insurance insurers save high. In comparison, clients feel safer and more protected.

Learn more about how AI and machine learning through Codegnan and learn the significance of technology in the evolution of every industry.